Portfolio Briefing – Fourth Quarter 2025

– Andrew Foster highlights three notable features of the Growth and Income Fund’s returns: a more diverse set of performance drivers than the EM benchmark, two value-unlocking events, and strong dividend growth. He explains that the Fund is benefiting from the propagation of artificial intelligence, but is less exposed than the benchmark to this source of return.

MorePortfolio Briefing – Fourth Quarter 2025

– Paul Espinosa reports that the Value Fund’s company-specific sources of return were uncorrelated with the EM benchmark’s sources of return. Brent Clayton introduces new Fund holdings in Brazil and India. Lastly, Paul and Brent explain where they see value opportunities in the portfolio.

MoreMoney Life – Interview with Andrew Foster

– In an interview with Money Life’s Chuck Jaffe, Andrew Foster discusses three important developments in the emerging markets: the U.S. dollar is not the dominant headwind it once was; earnings are growing for the second consecutive year; and dividends are surging. : As of September 30, 2025, Alibaba Group Holding, Ltd. comprised 3.0% of the Seafarer Overseas Growth and Income Fund. The Seafarer Funds did not own shares in the other securities referenced in this commentary. View the Seafarer Overseas Growth and Income Fund’s Top 10 Holdings. Holdings are subject to change. Listen

MoreWill Tariffs Crush Chinese Export Competitiveness?

– The continued growth of Chinese exports, in the face of rising tariffs and trade barriers, remains highly uncertain.

Will Tariffs Crush Chinese Export Competitiveness?Portfolio Review –

– Andrew Foster explains that while the EM benchmark rose largely due to technology stocks, the Growth and Income Fund’s gains were far more balanced across sectors. He discusses the robust 2025 EM corporate profit growth forecast and introduces two new Fund positions. Lastly, Andrew notes that dividends are rising among the Fund’s holdings, reflecting a shift toward improved capital management at EM companies.

Portfolio ReviewPortfolio Review –

– Brent Clayton explains that while the Value Fund lacks direct exposure to the largest emerging market AI-related stocks, a range of Fund holdings delivered gains stemming from improving sentiment in China and increasing returns of capital to shareholders. He describes how the Fund’s new holding in the UAE offers a balance of growth, stability, and yield.

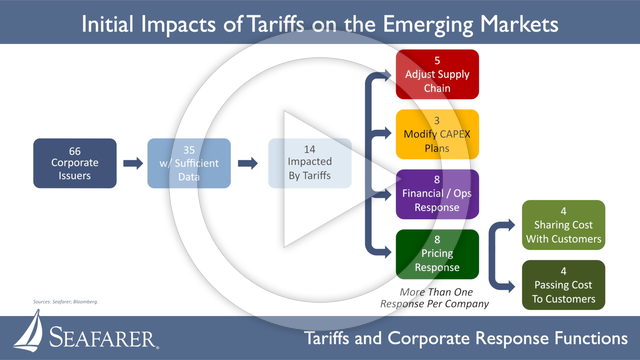

Portfolio ReviewInitial Impacts of Tariffs on the Emerging Markets

– Seafarer’s research on its portfolio holdings suggests that companies are only beginning to respond to the economic challenges posed by tariffs. While their responses are complicated and likely to evolve further, so far few EM companies seem to be footing the bill for tariffs — instead, it appears that downstream customers will bear the brunt of additional costs, at least initially.

MorePrevailing Winds

Learn MoreNobody Wins in a Price War: Destructive Competition in China

– Industrial policy in China has caused overcapacity and deflation. Government interference has made the problem worse by allowing unprofitable firms to avoid bankruptcy.

Destructive Competition in ChinaChina’s Models of Competition

– China’s unique models of competition help explain why some industries flourish while others stagnate.

China’s Models of Competition

What’s Wrong with Chinese Corporate Profits?

– State-owned firms’ disproportionate control of corporate profits sheds light on the biggest challenge facing the Chinese economy.

What’s Wrong with Chinese Corporate Profits?News and Commentary

Co-Chief Investment Officer Update

– Paul Espinosa was named Co-Chief Investment Officer (Co-CIO) of Seafarer Capital Partners, the adviser to the Seafarer Funds. Andrew Foster, the CIO of the Firm since its founding in 2011, will remain in the role, serving as Co-CIO alongside Paul.

MessageChina Leadership Monitor – The Economic Costs of China’s Self-Sufficiency Drive

– In an article for China Leadership Monitor, Nicholas Borst explains that China’s drive for economic self-reliance comes with significant tradeoffs and, ironically, may provoke some of the risks it seeks to avoid. : As of June 30, 2025, securities mentioned in this commentary comprised the following weights in the Seafarer Overseas Growth and Income Fund: Samsung Electronics, Co., Ltd. (3.5%), and Samsung Electronics Co., Ltd. Pfd. (0.9%). As of June 30, 2025, the Seafarer Funds did not own shares in the other securities referenced in this commentary. View the Seafarer Overseas Growth and Income Fund’s Top 10 Holdings. Holdings are subject to change.

MoreThe Wire China – Interview with Nicholas Borst

– In an interview with The Wire China, Seafarer’s Nicholas Borst discusses Beijing’s approach to managing its economy: utilizing private markets while maintaining state control.

MoreMoney Life – Interview with Andrew Foster

– In an interview with Money Life’s Chuck Jaffe, Andrew Foster reports on the growing earnings and strengthening currencies in emerging markets. He discusses the importance of gaining exposure to non-U.S. dollar sources of return, including diversified streams of investment income. Listen

MoreRevisiting the Seven Sources of Value in Emerging Markets

– Brent Clayton examines the practical lessons Seafarer’s Value team has learned in its pursuit of seven distinct sources of value in emerging markets.

MoreFund Resources

Field Notes

Explore Our MapSeoul: The Corporate Big Leagues

– The outsized influence of South Korea’s large family-run conglomerates in daily life was driven home at the ballpark.

MoreSeoul: Taxes, and the Corporate Value-up Program

– A new national initiative in South Korea aims to improve the capital efficiency of listed corporates and bring about better treatment of minority shareholders.

MoreSão Paulo: Pharmacies on Every Corner

– Pharmacies in Brazil are becoming service hubs and occupying a more prominent role in the healthcare industry.

More![[Chrome]](/_layout/images/ua/chrome.png)

![[Firefox]](/_layout/images/ua/firefox.png)

![[Opera]](/_layout/images/ua/opera.png)

![[Microsoft Edge]](/_layout/images/ua/edge.png)