China’s Models of Competition

– Nicholas Borst introduces three models of competition – naturally forming, policy-induced, and state-controlled – that help explain sharp differences among industries in China.

MorePortfolio Briefing – Second Quarter 2025

– Andrew Foster explains that currency gains and holdings in the financial and consumer sectors drove the Growth and Income Fund’s performance. Nicholas Borst compares market returns in Hong Kong versus mainland China and assesses U.S.-China trade relations. Andrew discusses a change in how EM currencies operate relative to the U.S. dollar.

MorePortfolio Briefing – Second Quarter 2025

– Paul Espinosa discusses the fundamental drivers of the Value Fund’s performance in the quarter: return of capital, the “Breakup Value” source of value, and emerging revenue growth. Brent Clayton reports on the state of corporate governance reform in South Korea. Paul describes the shared qualities of the Fund’s bank holdings.

MorePortfolio Briefing – First Quarter 2025

– Paul Espinosa reports that company fundamentals drove stock prices for the Growth and Income Fund’s top contributors, and he explains why it was a “quarter of surprises.” Lydia So discusses how Fund holdings may be impacted by tariffs. Paul and Lydia introduce two new holdings, a bank and a medical device manufacturer.

MorePortfolio Briefing – First Quarter 2025

– Paul Espinosa reviews the portfolio holdings that impacted Value Fund performance. He notes that WH Group listed its U.S. subsidiary during the quarter, which helped the company to unlock value that was trapped on its balance sheet. Paul provides updates on the Fund’s China exposure and cash level.

MorePortfolio Briefing – Fourth Quarter 2024

– Andrew Foster discusses the large impact of currency weakness on Growth and Income Fund performance. Kate Jaquet notes that consumer staples and tech holdings were a drag on performance. Andrew reports on a new position, and highlights the resilient fundamentals and rising dividends of the Fund’s holdings.

MorePortfolio Briefing – Fourth Quarter 2024

– Paul Espinosa discusses portfolio holdings that impacted Value Fund performance. Brent Clayton addresses Brazil’s volatile environment in the context of the Value strategy. He also describes how Seafarer considers a company’s capital allocation in the research process.

MoreChina 2025 Outlook

– After a recent trip to China, Nicholas Borst reports that while the Chinese economy is showing some signs of stabilization, there are still long-term structural problems holding back economic growth.

MoreRevisiting the Seven Sources of Value in Emerging Markets

– Brent Clayton examines the practical lessons Seafarer’s Value team has learned in its pursuit of seven distinct sources of value in emerging markets.

MorePortfolio Briefing – Third Quarter 2024

– Nicholas Borst reports that China stocks rose sharply in response to recent stimulus announcements, and he reviews the four major problems that have weighed down China’s economy. Paul Espinosa notes that earnings and dividend growth from Growth and Income Fund holdings drove performance. Lydia So highlights specific contributors and detractors to Fund returns and introduces a new position in Vietnam.

MorePortfolio Briefing – Third Quarter 2024

– Brent Clayton discusses a new Value Fund holding, Arcos Dorados, the largest independent McDonald’s franchisee. Paul Espinosa reviews the top contributors to Fund performance and explains the significance of rising dividends in the Fund’s portfolio.

MorePortfolio Briefing – Second Quarter 2024

– Andrew Foster examines two events shaping EM this year: a broad-based earnings recovery and currency weakness. He discusses the Growth and Income Fund’s performance and provides his assessment of the portfolio companies’ fundamentals and earnings growth. Paul Espinosa introduces a new Fund holding in China/Hong Kong.

MorePortfolio Briefing – Second Quarter 2024

– Brent Clayton reviews the key drivers of Value Fund performance, noting that gains in India and China were offset by declines in Brazil and Georgia. He and Paul Espinosa discuss takeaways from their research trip to China and Korea, including a new Fund holding – Hongkong Land – and corporate reactions to the Value-up program in Korea.

MorePortfolio Briefing – First Quarter 2024

– Andrew Foster explains that as markets rose on speculation around AI, the Growth and Income Fund’s performance was driven by holdings in India and South Korea as well as consumer stocks. He describes how DBS Group, a new holding, fits into the strategy, as a stable grower that has the capacity to pay high dividends. Lydia So discusses robust cash flow generation at Hermès.

MorePortfolio Briefing – First Quarter 2024

– Paul Espinosa discusses the Value Fund’s performance and notes that the Fund is finding value in companies that are “off the beaten path” in the EM universe. He and Brent Clayton report on the Fund’s search for value in China. Brent highlights the potential for improved corporate governance in South Korea.

MorePortfolio Briefing – Fourth Quarter 2023

– Andrew Foster reports that amid a weak EM backdrop, the Growth and Income Fund’s holdings are forecast to produce, in the aggregate, modest positive earnings growth in 2023. He describes how the Fund’s performance drivers were quite different from those of the EM benchmark in the quarter.

MorePortfolio Briefing – Fourth Quarter 2023

– Brent Clayton discusses a new Value Fund holding, Tata Motors, an India-based multinational auto company. He explains why China continues to be a large source of compelling value opportunities. Paul Espinosa reviews key drivers of the Fund’s performance.

MorePortfolio Briefing – Third Quarter 2023

– Paul Espinosa and Lydia So discuss two additions to the Growth and Income Fund: Salik, a toll road operator in the UAE, and Hermès, a French luxury goods company that derives significant revenue from EM. Lydia explains that she looks for companies that can drive structural growth due to brand, pricing power, and critical infrastructure.

MorePortfolio Briefing – Third Quarter 2023

– Paul Espinosa explains that Value Fund performance was led by holdings from countries with low weightings in the EM benchmark: the United Arab Emirates, Georgia, and Vietnam. He discusses how stock selection helped the Fund mitigate the impact of the falling Chinese market.

MorePortfolio Briefing – Second Quarter 2023

– Andrew Foster reports that the Growth and Income Fund’s performance was driven by a diverse group of stocks, and he highlights four recent portfolio additions. Andrew describes China’s weak consumer and industrial demand, and the steps China’s leaders could take to offset the malaise. Paul Espinosa discusses a value holding in Brazil.

MorePortfolio Briefing – Second Quarter 2023

– Brent Clayton introduces a new Value Fund holding, Fertiglobe, a Middle Eastern fertilizer manufacturer. He illustrates how the Fund manages volatility using the example of Fund holding XP, Inc. Paul Espinosa discusses the Fund’s exposure to China and how he evaluates the associated geopolitical risk.

MoreChina’s Reopening and Corporate Expansion Overseas

– After a recent trip to China, Nicholas Borst reports on China’s reopening, the operating environment for the country’s private sector, and Chinese companies’ efforts to expand internationally.

MorePortfolio Briefing – First Quarter 2023

– Andrew Foster describes how misperceptions about China’s post-Covid re-opening swung markets, and how the Growth and Income Fund fared amid the swings. Paul Espinosa discusses the value he sees in a new holding in India. Andrew concludes by offering his views on what Alibaba’s restructuring announcement might mean.

MorePortfolio Briefing – First Quarter 2023

– Paul Espinosa explains that the Value Fund’s performance was led by Odontoprev in Brazil, Moneta Money Bank in the Czech Republic, and holdings such as Giordano that benefited from China’s re-opening. Brent Clayton discusses the resilience of the Fund’s bank holdings and introduces a new position, UPL, in India.

MorePortfolio Briefing – Fourth Quarter 2022

– Andrew Foster reports that the Growth and Income Fund’s performance was driven by recoveries in Asian, Eastern European, and semiconductor holdings. Lydia So introduces three new growth positions in Mexico and India, and Paul Espinosa discusses the Fund’s value holdings.

MorePortfolio Briefing – Fourth Quarter 2022

– Paul Espinosa discusses how Value Fund performance was driven in part by cyclical holdings that outperformed against headwinds. He notes that the Fund intends to provide shareholders with a differentiated source of return that is diversified from the market and shareholders’ other investments.

MoreChina 2023 Outlook

– Nicholas Borst discusses recent volatility affecting Chinese stocks and highlights four underappreciated aspects of investing in China. He also examines these topics in a Letter to Shareholders.

MorePortfolio Briefing – Third Quarter 2022

– Andrew Foster explains that in a difficult quarter for stock markets globally, the Growth and Income Fund was impacted by sharp corrections in China and South Korea. He notes that EM valuations are attractive for long-term investors, but cautions that investors should consider geopolitical and market risks related to China, Taiwan, Russia, and India.

MorePortfolio Briefing – Third Quarter 2022

– Amid a global sell-off in stocks, Paul Espinosa attributes the Value Fund’s outperformance versus the benchmark to the resilience of its holdings. Brent Clayton introduces a new Fund holding, Siam Cement, an industrial conglomerate that operates throughout Southeast Asia.

MorePortfolio Briefing – Second Quarter 2022

– Andrew Foster reports that the Growth and Income Fund re‑entered Alibaba because the valuation was attractive relative to the company’s potential. He notes that the Fund remains active in China despite its slowing growth, because it offers a broad and deep universe of companies.

MorePortfolio Briefing – Second Quarter 2022

– Paul Espinosa explains that contributors to the Value Fund’s performance (such as Giordano) were driven by stock-specific factors, while detractors (such as Pacific Basin) fell due to global recession concerns. He also describes the type of performance the Fund seeks to provide over a full market cycle.

MorePortfolio Briefing – First Quarter 2022

– Kate Jaquet reports that the Growth and Income Fund’s performance was primarily driven by the Fund’s lack of direct exposure to Russia and underweight position in China. She explains that the Fund was not invested in Russia due to corporate governance and control party risks identified during the bottom-up security selection process.

MorePortfolio Briefing – First Quarter 2022

– Paul Espinosa attributes the Value Fund’s performance to a geographically diverse set of holdings outside of China, and explains that stock selection allowed the Fund to avoid the brunt of the falling Chinese market. He discusses the Value Fund’s limited exposure to the Russia-Ukraine conflict.

MoreA Balance Sheet Approach to China

– Nicholas Borst explains that a balance sheet approach to analyzing the Chinese economy yields important insights into the country’s financial risks and overall resiliency.

MoreCould Smaller Emerging Markets Hold Value Opportunities?

– Daniel Duncan explains why a selective value approach – not a top-down search for growth – may be well suited for finding equity returns in frontier markets. This approach is also the topic of a commentary that addresses value investing in frontier markets.

MorePortfolio Briefing – Fourth Quarter 2021

– Andrew Foster describes how two Growth and Income Fund holdings unlocked value embedded in their balance sheets. He also offers a retrospective on the evolution in the Growth and Income strategy undertaken three years ago.

MorePortfolio Briefing – Fourth Quarter 2021

– Paul Espinosa discusses new positions in the Value Fund, including a property developer in the United Arab Emirates and a consumer snack company in China. He notes a shift in the portfolio composition to larger-cap, more liquid securities.

MorePortfolio Briefing – Third Quarter 2021

– Paul Espinosa explains that the Growth and Income Fund avoided headline risks in China related to real estate developers and the government crackdown on industries such as education. However, holdings in South Korea suffered, likely from anticipation of a global slowdown in GDP.

MorePortfolio Briefing – Third Quarter 2021

– Paul Espinosa discusses key drivers of Value Fund performance, including holdings impacted by Covid resurgence and holdings that performed well for stock-specific reasons. He also explains the factors he considers when managing the weighting of portfolio holdings.

MoreHow the Value Team Finds “Gems” in Emerging Markets

– Paul Espinosa describes four company attributes that guide the Value team’s search for “Gems”: ROE-COE spread, resilience across the company life cycle, global validation, and a valuation consistent with the minimum rate of return. The search for Gems is also examined in a commentary on the Value team’s stock selection process.

MorePortfolio Briefing – Second Quarter 2021

– Andrew Foster reports that the consensus estimate for 2021 EM corporate earnings growth has accelerated sharply, and explains why the current 59% estimate is highly questionable. He provides an update on the Growth and Income Fund’s cash level and discusses China’s stock market valuations.

MorePortfolio Briefing – Second Quarter 2021

– Paul Espinosa highlights portfolio holdings based in Hong Kong, Brazil, and Vietnam to illustrate how the Value Fund’s performance was driven by company-specific factors, not simply a “value rotation.” He explains that the Value team is finding potential opportunities with companies that actively improved their operations during the pandemic.

MoreManaging Currency Risk in the Emerging Markets

– Kate Jaquet provides an overview of Seafarer’s proprietary macro currency model, which is utilized to manage currency risks within the construct of a diversified portfolio of foreign securities. The currency model is the topic of a commentary written by Andrew Foster and Kate Jaquet.

MorePortfolio Briefing – First Quarter 2021

– Paul Espinosa provides examples of two categories of Value component stocks that led performance of the Growth and Income Fund in the quarter. He also describes the decision-making process behind the Fund’s increased exposure to the Value component in recent quarters.

MorePortfolio Briefing – First Quarter 2021

– Paul Espinosa attributes the Value Fund’s performance to holdings that were directly impacted by the pandemic but proved resilient, and rose when the market re-assessed their risks. Holdings that increased due to stock-specific reasons, such as Pacific Basin and Moneta Money Bank, also contributed to performance.

MoreNavigating the Complexities of SOEs in Emerging Markets

– Nicholas Borst, Paul Espinosa, and Andrew Foster explain that when evaluating emerging market companies, state control matters, more so than state ownership. Andrew outlines “exception” cases in which it can make sense to invest alongside a state control party, but explains that he wants to see state control decline over time, as more commercially oriented actors take greater control.

MorePortfolio Briefing – Fourth Quarter 2020

– Andrew Foster attributes the performance of the Growth and Income Fund to companies that offer resilient and durable earnings and cash flow growth despite the pandemic. He describes how the Fund’s positioning and cash levels changed over the course of a volatile year for emerging markets.

MorePortfolio Briefing – Fourth Quarter 2020

– Paul Espinosa discusses how Value Fund performance was led by a strong comeback of holdings that had sold off earlier in the year due to the pandemic. He describes the current risks associated with investment in the Fund and other asset classes, and notes that risk management requires diversification of the drivers of investment return.

MorePortfolio Briefing – Third Quarter 2020

– Andrew Foster explains that Chinese consumer stocks led performance of the EM index in the quarter. He reports that Growth and Income Fund constituents are projected to produce positive earnings growth in aggregate this year, even as profits are expected to contract for the broader EM universe. Andrew attributes this outlook for the Fund to increasing industry leadership on the part of several Fund holdings.

MorePortfolio Briefing – Third Quarter 2020

– Paul Espinosa explains that in the current growth-focused market environment, the Value Fund remains committed to pursuing long-term value opportunities. He discusses two top contributors in this context. Paul also notes three categories of stocks that have detracted from performance this year. Lastly, he explains that the search for value is leading the Fund to Brazil, with two new holdings.

MorePortfolio Briefing – Second Quarter 2020

– Andrew Foster continues to flag caution over markets as weak economic and corporate fundamentals combine with high valuations. He notes that in contrast to the broader EM, over half of the Growth and Income Fund’s constituents are expected to produce positive earnings growth this year. Lastly, Andrew expresses grave concerns for the future of economic and political freedoms in Hong Kong, given the new security law imposed by China.

MorePortfolio Briefing – Second Quarter 2020

– Paul Espinosa describes how large cap, cyclical companies led performance of the Value Fund, while small caps detracted from performance. He explains that the Fund is adding large caps and “gems” (companies with high returns on capital, good management and capital discipline) with once-in-a-cycle valuation levels. Paul highlights the addition of Mondi, a global packaging and paper company, to the portfolio.

MoreA Tale of Two Indices – Discussion with Steph Gan

– Steph Gan speaks with Andrew Foster about her commentary A Tale of Two Indices, which examines how countries and industries that represent the next leg of the developing world’s emergence are likely to be under-represented in leading emerging market indices.

MorePortfolio Briefing – First Quarter 2020

– Andrew Foster suggests that two major factors drove equity markets lower around the world: the impact of the Covid-19 pandemic itself, and the breakdown of liquidity in certain markets. He explains that companies in the Growth and Income Fund face an uncertain outlook, but do not face liquidity strains at present. Andrew describes the two types of portfolio holdings that have been relatively resilient in the downturn.

MorePortfolio Briefing – First Quarter 2020

– Paul Espinosa explains that the Value Fund is finding opportunities to buy quality stocks at low valuations. He notes that the Fund exited four positions in order to concentrate the portfolio in higher conviction and higher liquidity securities. Paul also discusses the Fund’s approach to liquidity management.

MorePortfolio Briefing – Fourth Quarter 2019

– Paul Espinosa describes how large cap technology companies contributed to the performance of both the Growth and Income Fund and the benchmark index, but the Fund also benefited from unique holdings outside of technology. Paul highlights two Fund holdings – Richter Gedeon and Qualicorp – as he explains how Seafarer seeks growing cash flows, the return of cash flows to shareholders, and drivers of growth that are endogenous to a company.

MorePortfolio Briefing – Fourth Quarter 2019

– Paul Espinosa explains that while large cap technology companies led performance of the emerging markets universe, Value Fund performance was chiefly driven by contributions from stocks unrelated to technology or China. Paul describes the sell discipline of the Value Fund as a constant reassessment of whether the return the Fund derives as an investor in a company is lower than the company’s return on equity.

MorePortfolio Briefing – Third Quarter 2019

– Andrew Foster explains that, amid a slowdown in corporate earnings growth rates in the emerging markets, the Growth and Income Fund’s holdings exhibited resilient corporate performance and earnings growth. Andrew highlights two Fund holdings – Hyundai Mobis and Venture Manufacturing – that have diversified their businesses to sustain growth.

MorePortfolio Briefing – Third Quarter 2019

– Paul Espinosa notes that macro developments – specifically the U.S.-China trade war and Hong Kong protests – impacted the emerging markets universe, but Value Fund performance was largely driven by company-specific factors. In addition, Paul explains that minority shareholders are increasingly able to realize value in emerging markets due to improving corporate governance, and he cites two portfolio holdings as recent examples.

MorePortfolio Briefing – Second Quarter 2019

– Paul Espinosa discusses the performance drivers of the Growth and Income Fund, and how they differed from those of the benchmark index. When performance contribution is viewed by country, China was a positive contributor to Fund performance, while it was the largest detractor to index performance.

MorePortfolio Briefing – Second Quarter 2019

– As the Value Fund reaches its three-year anniversary, Paul Espinosa reflects on its performance relative to his expectations at the Fund’s inception. Paul also discusses how Seafarer’s framework of seven distinct sources of value in emerging markets informs each step of the Fund’s investment process.

MoreChina’s Stock Connect – Insights from the Trading Team

– Nicholas Borst speaks with two members of Seafarer’s trading team, Chris Clayton and Alex Lusherovich, about how China’s Stock Connect program is changing the way foreign investors access the A-share market.

MorePortfolio Briefing – First Quarter 2019

– Inbok Song describes five characteristics she looks for in growth-oriented holdings for the Growth and Income Fund. She also discusses two Fund holdings: China Yangtze Power, a Chinese A-Share-listed provider of hydropower, and Techtronic, a Hong Kong-based provider of industrial tools.

MorePortfolio Briefing – First Quarter 2019

– Paul Espinosa explains that the key drivers of return for the Value Fund during the quarter were earnings growth, asset restructuring, and exogenous factors. He notes that the Value strategy views risk in terms of the operational performance of companies.

MorePortfolio Briefing – Fourth Quarter 2018

– Andrew Foster provides a comparison of the portfolio’s construct before and after the Growth and Income Fund’s restructuring. He explains how new holdings have broadened the growth and value components of the Fund. Andrew also discusses Hyundai Mobis, one of the Fund’s largest holdings, and its role in the portfolio.

MorePortfolio Briefing – Fourth Quarter 2018

– Paul Espinosa discusses how market and stock-specific developments impacted Value Fund holdings, and explains that performance was not dominated by China. Paul describes how he adds to portfolio positions that are experiencing price declines, once he assesses that company fundamentals and valuations are sound.

MoreChina’s Campaign to Develop Advanced Technologies

– Nicholas Borst speaks with Inbok Song about his white paper on China’s campaign to develop advanced technologies. Nicholas describes the government’s desire to move up the economic value chain and reduce dependency on foreign-controlled technology. He also addresses the impact of U.S.-China trade tensions on China’s technology campaign.

MoreChina’s Belt and Road Initiative

– Nicholas Borst and Steph Gan examine China’s Belt and Road initiative, the topic of a white paper written by Steph. They discuss China’s motivations behind its ambitious vision for global trade and infrastructure development, as well as the risks of the initiative.

MorePortfolio Briefing – Third Quarter 2018

– Daniel Duncan and Andrew Foster discuss the reasons behind the Growth and Income Fund’s increasing exposure to the value and growth “tails.” Andrew explains why Paul Espinosa and Inbok Song were promoted to Lead Portfolio Managers of the Fund during the quarter. Paul and Inbok describe how they select value- and growth-oriented positions for the Fund, respectively.

MorePortfolio Briefing – Third Quarter 2018

– Daniel Duncan and Paul Espinosa discuss the primary drivers of return in the Value Fund during the quarter, including the retreat of China holdings tied to consumer discretionary spending. Paul explains how the pullback in emerging markets affects the search for value-oriented Fund holdings.

MorePortfolio Briefing – Second Quarter 2018

– Daniel Duncan and Andrew Foster discuss how China’s rise as a global hegemon is structurally changing the risk-return profile of the emerging markets. Andrew explains that in response, Seafarer’s approach to balancing the trade-off between growth and income in the Fund is evolving.

MorePortfolio Briefing – Second Quarter 2018

– Daniel Duncan and Paul Espinosa discuss the primary drivers of return in the Value Fund during the quarter. Paul describes key insights gained from recent meetings with company management. He also explains how risk is managed in the portfolio.

MorePortfolio Briefing – First Quarter 2018

– Daniel Duncan and Andrew Foster discuss the Growth and Income Fund’s performance and the pronounced volatility of emerging markets during the quarter. Andrew notes that the volatility, following sustained outperformance in emerging markets, suggests potentially challenging conditions ahead.

MorePortfolio Briefing – First Quarter 2018

– Daniel Duncan and Paul Espinosa discuss the top contributors and detractors to Value Fund performance during the quarter. Paul explains that the performance of these holdings was asynchronous to that of the emerging markets index. He concludes by noting that the declines in the index created buying opportunities for the Fund.

MorePortfolio Briefing – Fourth Quarter 2017

– Daniel Duncan and Andrew Foster discuss the robust growth in emerging markets in the quarter and the year, and how it has been concentrated in a narrow set of sectors and countries. Andrew explains that concern about the sustainability of valuations has led him to position the Growth and Income Fund more defensively. On the topic of China, Andrew asserts that the country’s influence and importance in the world have never been greater, even as he is concerned about its long-term evolution.

MorePortfolio Briefing – Fourth Quarter 2017

– Daniel Duncan and Paul Espinosa discuss the plateau of the Value Fund’s NAV during the quarter, which Paul attributes to a collection of stock specific developments. Paul explains that when a holding is struggling, he will add to the position if the company’s operations are evolving according to plan. He illustrates the Value strategy’s focus on IRR (versus target price) using the example of Fund holding Pegas Nonwovens.

MoreA Value Approach to Emerging Markets

– Paul Espinosa describes the structural changes that have made it possible to realize a value strategy in emerging markets. He explains how the strategy’s research process is based on Seafarer’s framework of seven distinct sources of value in emerging markets.

MorePortfolio Briefing – Third Quarter 2017

– Daniel Duncan and Andrew Foster discuss how the Growth and Income Fund continues to invest in Chinese companies that offer sustainable growth and current income – despite concerns about speculative conditions within certain segments of the Chinese market. Andrew provides an update on three false narratives prevalent in emerging markets, asserting that they represent the preconditions for decoupling of the asset class.

MorePortfolio Briefing – Third Quarter 2017

– Daniel Duncan and Paul Espinosa discuss a Value Fund holding in the Czech Republic that experienced a partial realization of value during the quarter. Paul describes current research efforts, including on-site visits to assess operational turnarounds at portfolio holdings in Asia.

MorePortfolio Briefing – Second Quarter 2017

– Daniel Duncan and Andrew Foster discuss the gains in the Fund and index during the quarter, including the impact of the Chinese internet sector. Andrew addresses several false narratives about emerging market currencies and earnings growth. He notes that a broad-based recovery in earnings growth is underway, benefitting most sectors – but it appears to be a “two-speed” recovery, one which so far favors larger companies over smaller ones. Andrew concludes by noting that expectations for growth have become ebullient, and may overstate reality.

MorePortfolio Briefing – Second Quarter 2017

– Daniel Duncan and Paul Espinosa discuss two Fund holdings that realized value in the second quarter: a packaging company in China and a cooling services company in the United Arab Emirates. Paul illustrates how geopolitical risk affects company analysis with a Fund holding in Qatar. Lastly, he describes a new Fund holding in China.

MorePortfolio Briefing – First Quarter 2017

– Daniel Duncan and Andrew Foster discuss the factors affecting Fund and emerging market performance, including currency stability and a pick-up in earnings growth. Andrew describes two portfolio allocation decisions during the quarter: to withdraw the Fund’s capital from Turkey and establish the Fund’s first Chinese A-share position via the Shanghai-Hong Kong Stock Connect. Finally, he expresses concerns regarding rising earnings growth expectations and financial conditions in China.

MorePortfolio Briefing – First Quarter 2017

– Daniel Duncan and Paul Espinosa discuss new Latin America and Middle East holdings in the Value Fund. Paul describes his expectations for Fund performance as independent of the benchmark and representing a “step function.” Lastly, he provides an overview of current research efforts focused on China, the Philippines, and Sri Lanka.

MoreChanges to Chinese Currency Policy – Update

– Daniel Duncan and Andrew Foster provide an update to their August 2015 video that addressed China’s steps to liberalize how its currency trades against the U.S. dollar. Andrew notes that, just over one year later, China is rolling back some of those liberalizations. He suggests that these policy changes are signs of strained liquidity conditions, and that risks in China’s financial system are consequently elevated.

MorePortfolio Briefing – Fourth Quarter 2016

– Daniel Duncan and Andrew Foster discuss the losses in the emerging markets and the Growth and Income Fund during the fourth quarter. Andrew notes that the Fund’s losses were spurred by the performance of certain emerging market currencies in the aftermath of the U.S. presidential election.

MorePortfolio Briefing – Fourth Quarter 2016

– Daniel Duncan and Paul Espinosa discuss the top contributors and detractors to Value Fund performance during the fourth quarter. Paul relates certain of those holdings to the seven sources of value in emerging markets that he defined in a recent white paper.

MorePortfolio Briefing – Third Quarter 2016

– In the third quarter portfolio briefing, Andrew Foster discusses the purpose behind the recently-launched Seafarer Overseas Value Fund. Paul Espinosa describes the Value Fund’s implementation since launch, relating it to the seven sources of value in emerging markets that he defined in a recent white paper. Andrew concludes by addressing performance during the quarter, and how the Seafarer Overseas Growth and Income Fund is faring amid potential changes in the market environment.

MorePortfolio Briefing – Second Quarter 2016

– Daniel Duncan and Andrew Foster discuss developments in Brazil and China that shaped the performance of the emerging markets and the Fund during the second quarter. Daniel probes the effect of the announcement of Britain’s exit from the European Union on the Fund; Andrew explains that Poland provides the majority of the Fund’s EU exposure, and that this event exacerbates an already challenging economic landscape in Poland. Andrew also notes the elevated financial risks in China, stating that his chief concern is growing illiquidity in the corporate sector, as evident by a dramatic increase in accounts receivable.

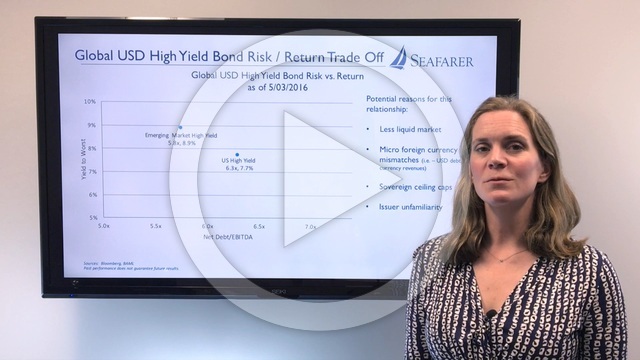

MoreHigh Yield Bonds in the Emerging Markets

– Kate Jaquet examines corporate bond opportunities in the emerging markets, comparing the credit quality and valuation of emerging market versus U.S. high yield bonds.

MoreValue in the Emerging Markets – May 2016

– Paul Espinosa examines the universe of value stocks that lie within the emerging markets. Rather than rely on basic quantitative measures to distinguish “cheap” stocks from “expensive” ones, Paul defines seven distinct sources of value that might represent viable opportunities for long-term, value-oriented investments. He applies these seven definitions to the securities universe within the emerging markets and discovers a subset worth $1.4 trillion. Paul concludes by noting that the opportunity to find value in emerging markets is large, diverse, and displays compelling valuation characteristics.

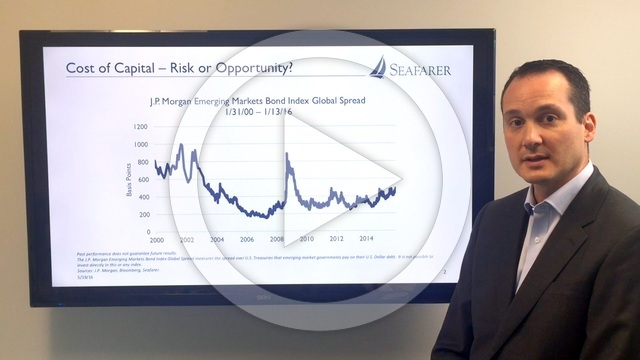

MorePortfolio Briefing – First Quarter 2016

– Daniel Duncan and Andrew Foster discuss the volatile nature of emerging markets in the first quarter, largely driven by economic and political challenges impacting China and Brazil. In this context, Andrew stresses the importance of finding companies that are survivors – those that can produce attractive rates of profitability and sustained growth even in difficult macroeconomic circumstances. Andrew concludes by describing the factors he considers when managing the weighting of portfolio holdings, especially during periods of market volatility.

MorePortfolio Briefing – Fourth Quarter 2015

– Daniel Duncan and Andrew Foster discuss the performance of the emerging markets and the Fund during the fourth quarter. Next, Daniel probes the influence of politics on markets; Andrew asserts that the political woes weighing on the developing world are mainly the symptom of economic weakness rather than the cause of it. Andrew concludes by touching upon the Fund’s current positioning, and noting that within the emerging markets, large capitalization stocks (above US $10 billion in size) generally offer the best relative value.

MoreThe Role of Preferred Equities, Convertible Bonds, and Fixed Income

– Kate Jaquet discusses how non-common stock holdings allow the Seafarer Overseas Growth and Income Fund to optimize the tradeoff between prospective growth and current income, and can help the Fund to achieve its investment objectives.

MorePortfolio Briefing – Third Quarter 2015

– Daniel Duncan and Andrew Foster discuss the pronounced weakness among emerging market currencies, along with the consequences for stock markets and the Fund. Andrew suggests a slow-moving currency crisis is underway, and he discusses notable differences versus previous currency crises. Lastly, he provides an update on China, including his thoughts on the country’s new currency policy and the government’s attempts to manage the economy and financial markets.

MoreOverview of Risk Management Practices

– Daniel Duncan, Andrew Foster, and Kate Jaquet discuss Seafarer’s approach to managing risk and volatility in the Seafarer Overseas Growth and Income Fund. They address three frameworks that Seafarer employs to understand and measure risk in the portfolio: individual security (issuer) risk analysis, a micro currency risk model, and a macro currency risk model.

MoreRecent Market Volatility

– Daniel Duncan and Andrew Foster discuss the factors contributing to pronounced market volatility, including currency weakness in emerging markets and recent shifts in China’s currency policy.

MoreChanges to Chinese Currency Policy

– Daniel Duncan and Andrew Foster discuss recent changes to the exchange rate mechanism for the Chinese Renminbi, along with some of the potential consequences for financial markets.

MoreChina’s Emergence, In Context

– Andrew Foster admits that valuations on individual Chinese stocks are unsustainable and are likely to collapse. However, in his opinion, the overall growth of Chinese stock market capitalization does not constitute an ordinary bubble – the situation is far more complex. Andrew offers some data from history to place the evolution of China’s markets in context. He examines how the re-allocation of Chinese household wealth – away from property, and towards equities – might induce some of the Chinese market’s recent gyrations.

MorePortfolio Briefing – Second Quarter 2015

– Daniel Duncan and Andrew Foster discuss the volatile nature of markets during the second quarter, and the factors that ostensibly induced that volatility – namely currencies, Greece, and China. Andrew suggests that current valuations for many Chinese shares are unsustainable, and will – with the benefit of hindsight – likely be termed as “bubbles.” They conclude with a brief discussion of the Fund’s allocation to Chinese equities.

MorePortfolio Briefing – First Quarter 2015

– Daniel Duncan and Andrew Foster discuss the Seafarer Fund’s performance since inception, and how the Fund’s strategy seeks “sustainable growth.” They also address the impact of currency risk, and how the recent deceleration in growth in the developing markets might soon subside.

MoreCurrency Risk, In Context

– Andrew Foster discusses how currency risk impacts the portfolios of long-term investors in the developing world.

MorePortfolio Briefing – Fourth Quarter 2014

– Daniel Duncan and Andrew Foster discuss the Seafarer Fund’s performance, allocation, and outlook.

More![[Chrome]](/_layout/images/ua/chrome.png)

![[Firefox]](/_layout/images/ua/firefox.png)

![[Opera]](/_layout/images/ua/opera.png)

![[Microsoft Edge]](/_layout/images/ua/edge.png)