Prevailing Winds is a China-focused blog written by Nicholas Borst, Director of China Research at Seafarer. The blog tracks the economic and financial developments shaping the world’s largest emerging market. @NBorstSF

Will Tariffs Crush Chinese Export Competitiveness?

– The continued growth of Chinese exports, in the face of rising tariffs and trade barriers, remains highly uncertain.

Will Tariffs Crush Chinese Export Competitiveness?Destructive Competition in China

– Industrial policy in China has caused overcapacity and deflation. Government interference has made the problem worse by allowing unprofitable firms to avoid bankruptcy.

Destructive Competition in ChinaChina’s Models of Competition

– China’s unique models of competition help explain why some industries flourish while others stagnate.

China’s Models of CompetitionWhat’s Wrong with Chinese Corporate Profits?

– State-owned firms’ disproportionate control of corporate profits sheds light on the biggest challenge facing the Chinese economy.

What’s Wrong with Chinese Corporate Profits?America First Investment Policy: What it Means for U.S.-China Relations

– In an interview with the National Committee on U.S.-China Relations, Nicholas Borst discusses the implications of the U.S. administration’s new America First Investment Policy for U.S.-China economic and trade relations.

America First Investment Policy: What it Means for U.S.-China RelationsChina 2025 Outlook

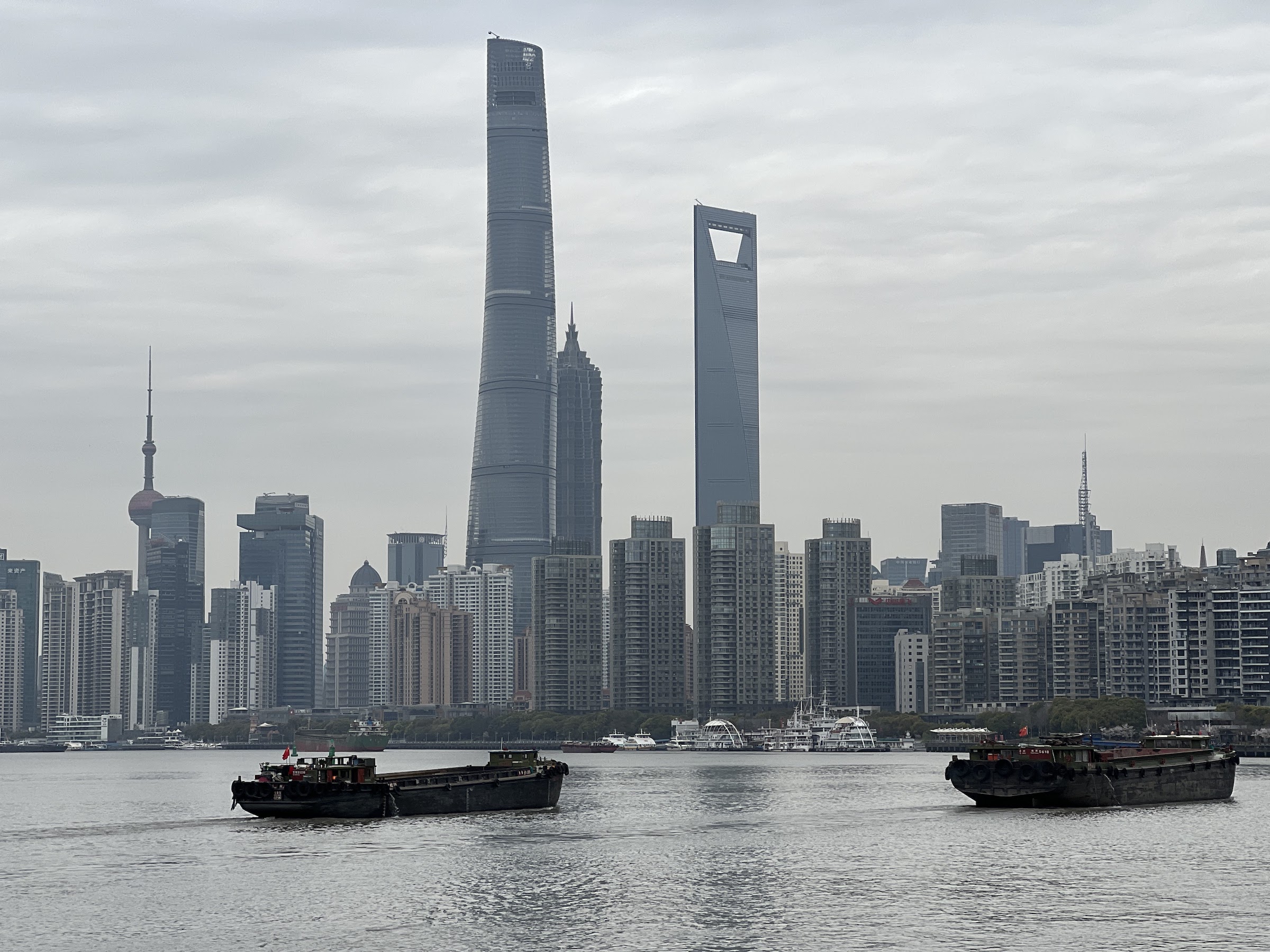

– After a recent trip to China, Nicholas Borst reports that while the Chinese economy is showing some signs of stabilization, there are still long-term structural problems holding back economic growth.

MoreWhy Does China Need to Recapitalize its Banks?

– A pledge to recapitalize banks in China is a tacit admission the banks are struggling to meet the demands placed on their balance sheets.

Why Does China Need to Recapitalize its Banks?Are China’s Economic Challenges Cyclical or Structural?

– China’s economy is weighed down on four fronts – real estate, consumption, fiscal issues, and the private sector – and political obstacles are standing in the way of addressing these problems.

Are China’s Economic Challenges Cyclical or Structural?After the Boom: What China’s Slowing Economy Means for Global Markets

– Nicholas Borst moderated a panel that examined how China’s new economic trajectory will impact global markets and the potential implications for investors.

After the Boom: What China’s Slowing Economy Means for Global MarketsThe Balance Sheets at Risk from China’s Property Slowdown

– The fallout from the end of China’s property boom will continue for many years as its effects ripple through the balance sheets of property developers, banks, and local governments.

The Balance Sheets at Risk from China’s Property SlowdownCan Consumption Save the Chinese Economy?

– To avoid a long-term slowdown in economic growth, Chinese policymakers need to change tactics and boost household consumption.

MoreTestimony – China’s Economy: Implications for Investors

– In testimony to the U.S.-China Economic and Security Review Commission, Nicholas Borst discusses the causes of China’s economic slowdown and the risks of local government debt.

Testimony – China’s Current EconomyChina’s Reopening and Corporate Expansion Overseas

– After a recent trip to China, Nicholas Borst reports on China’s reopening, the operating environment for the country’s private sector, and Chinese companies’ efforts to expand internationally.

MoreOf Profits and Peril: Corporate China’s Push Abroad

– Chinese companies are making an unprecedented effort to expand internationally, yet they face growing restrictions in the U.S. and other global markets.

Of Profits and Peril: Corporate China’s Push AbroadChina’s Balance Sheet Challenge

– In an article for China Leadership Monitor, Nicholas Borst examines the scale of China’s debt problem and how policymakers can put the country’s balance sheet on firmer footing.

China’s Balance Sheet ChallengeChina 2023 Outlook

– Despite significant challenges facing Chinese companies, there are reasons to be optimistic that China will continue to provide attractive investment opportunities.

China 2023 OutlookU.S.-China Economic Conflict: Implications for Investors and the Business Community

– Nicholas Borst moderated a panel that examined what the strained relationship between the world’s two largest economies means for investors and businesses.

U.S.-China Economic Conflict: Implications for Investors and the Business CommunitySecurity Over Growth: China’s New Economic Approach

– A growing sense of internal and external vulnerability has led Xi Jinping to emphasize security and political concerns in China’s economic policy.

Security Over Growth: China’s New Economic ApproachThe Balance Sheet Constraints on China’s Economic Stimulus

– As China faces major economic headwinds, Beijing’s attempts to stimulate growth are constrained by large contingent liabilities and a struggle for fiscal control with local governments.

The Balance Sheet Constraints on China’s Economic StimulusFixing China’s Broken Balance Sheets

– China’s approach to repairing weak balance sheets and preventing financial instability reflects lessons learned from past crises and the current priorities of Xi Jinping.

Fixing China’s Broken Balance SheetsHow Strong is China’s Household Balance Sheet?

– China’s household balance sheet is stronger than commonly thought, but it is still vulnerable to shifts in the real estate market.

How Strong is China’s Household Balance Sheet?China’s National Balance Sheet – A Framework for Analysis

– The risks of China’s economy and debt levels should be evaluated in the context of its national balance sheet – taking into account the interconnected assets and liabilities between households, corporations, financial institutions, and the government.

China’s National Balance Sheet – A Framework for AnalysisRisks and Opportunities: The U.S.-China Financial Relationship

– In an Asia Society Conference panel, Nicholas Borst explains why the U.S. and China share responsibility for the current state of the deteriorating bilateral investment relationship.

Risks and Opportunities: The U.S.-China Financial RelationshipChina’s Complicated Relationship with the Private Sector

– In response to a large and freewheeling private economy, the Chinese government under Xi Jinping is engaging in a widespread campaign to assert greater control over the private sector.

China’s Complicated Relationship with the Private SectorChina’s Credit Crackdown: Financial Risks and Political Red Lines

– Efforts by Chinese regulators to stamp out risks will fall short as long as China’s financial system exists in its current suboptimal state of partial liberalization.

China’s Credit Crackdown: Financial Risks and Political Red LinesParty Committees in Chinese Companies

– Renewed efforts to expand the Chinese Communist Party’s role in companies are antithetical to China’s desire to be treated as a modern market-based economy.

SOE Reform in China – Implications for Policymakers and InvestorsSOE Reform in China – Implications for Policymakers and Investors

– A rules-based and transparent approach to managing state-owned enterprises is in China’s economic interest and will provide clarity for foreign investors.

SOE Reform in China – Implications for Policymakers and InvestorsRebalancing the U.S.-China Economic Relationship

– In an Asia Society Conference panel, Nicholas Borst explains how the increase in holdings of Chinese securities by U.S. investors has emerged as a major source of conflict in the U.S.-China economic relationship.

Rebalancing the U.S.-China Economic RelationshipHow Exposed Are U.S. Investors to China?

– U.S. investors have invested more in China than the official statistics indicate, but remain less important as a financing source for Chinese companies than policymakers and the media may imagine.

How Exposed Are U.S. Investors to China?Tracking China’s Foreign Debt

– China leads the emerging markets in foreign debt, but a closer analysis reveals that China’s foreign borrowing is less risky than it appears, and is manageable relative to the size of the economy.

Tracking China’s Foreign DebtHave Foreign-listed Chinese Stocks Been a Bad Deal for Investors?

– Contrary to the assertions of many critics, foreign-listed Chinese firms – particularly those listed in the U.S. – have provided attractive returns for investors over the past decade.

MoreThe China Investment Dilemma – Part IV

How to Navigate a Tumultuous U.S.-China Relationship

– The fourth and final installment of The China Investment Dilemma: Risks for U.S. Investors During a Turbulent Time offers a disciplined approach to navigating the challenges posed by the volatile U.S.-China relationship.

MoreDivest and Delist? The Case Against Exiting China

– Efforts to limit foreign investment in Chinese companies will be a significant setback for corporate reforms in China.

MoreThe China Investment Dilemma – Part III

Risks for U.S. Investors in China

– The third installment of The China Investment Dilemma: Risks for U.S. Investors During a Turbulent Time examines why the challenged U.S.-China relationship is creating a new set of risks for U.S. investors in China.

MoreThe China Investment Dilemma – Part II

The Rocky State of the U.S.-China Relationship

– The second installment of The China Investment Dilemma: Risks for U.S. Investors During a Turbulent Time reviews major trends behind the deteriorating trajectory of U.S.-China bilateral relations.

MoreHas Covid-19 Led to Financial Instability in China?

– While China’s financial system weathered the initial stages of the Covid-19 crisis well, heightened risks warrant vigilance.

MoreThe China Investment Dilemma – Part I

China’s Financial Rise

– The first installment of The China Investment Dilemma: Risks for U.S. Investors During a Turbulent Time explains how China’s emergence as a major investment destination is driven by the size, depth, and increasing openness of its capital markets.

MoreState-owned Enterprises and Investing in China

– State influence over companies in China defies easy categorization and depends on both ownership levels and government policy priorities.

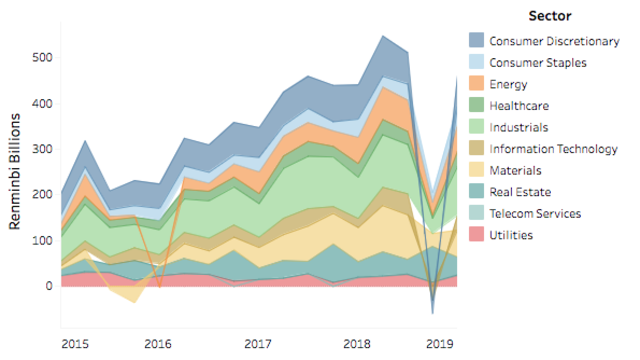

MoreVisualizing China’s A-Share Market Selloffs

– China’s stock market corrections in 2015 and 2018 illustrate the volatility and peculiar tendencies of the A-share market.

A Tale of Two CorrectionsTestimony – What Keeps Xi Up at Night

– In testimony to the U.S.-China Economic and Security Review Commission, Nicholas Borst describes the array of challenges facing the Chinese economy and the structural reforms that would help China achieve sustainable economic growth.

Looking Back on China’s 2018Looking Back on China’s 2018

– China experienced a tumultuous 2018 full of headwinds that drove down equity markets and economic sentiment, but trade growth and private sector resilience remain positive long-term trends.

Looking Back on China’s 2018China’s Private Sector is Feeling the Pinch

– While new government policies in China may ease the financing challenges faced by the private sector, truly leveling the playing field between private and state-owned enterprises will require structural reforms and take years to implement.

China’s Private Sector is Feeling the PinchHow Artificial Intelligence is Shaping Industries Across China

– China has rapidly emerged as a world-class innovator in the field of artificial intelligence and is at the forefront of applying AI to solve real world business problems.

How Artificial Intelligence is Shaping Industries Across ChinaChina’s Tech Rush

– China’s campaign to advance its technological capabilities has the potential to transform many emerging high-tech industries through an unprecedented level of government support and cooperation with the private sector.

China’s Tech RushHow Open Are China’s Capital Markets to Foreign Investment?

– The current stock market correction in China is serving as a useful test of the commitment of policymakers to maintaining recent financial reforms in the face of financial volatility.

How Open Are China’s Capital Markets to Foreign Investment?China’s Crackdown on Financial Risks

– Following financial shocks in China in 2015 and 2016, Chinese authorities have taken steps to reduce risks across the financial system and slow the growth rate of credit, particularly in the shadow banking system.

China’s Crackdown on Financial RisksFixing China’s Municipal Bond Market

– A viable municipal bond market has developed in China, in response to the growing fiscal needs of local governments – but challenges remain, including high levels of borrowing and the availability of long-term financing.

Fixing China’s Municipal Bond MarketChina’s Investment Numbers Don’t Add Up

– While each release of China’s fixed asset investment numbers generates news headlines, the data should be treated with a healthy dose of skepticism until China completes reforms to its statistical methodology.

China’s Investment Numbers Don’t Add UpForty Years Later: China in a New Era

– The recent China Development Forum celebrated China’s economic achievements, but it also highlighted a large shift occurring across China: the Communist Party’s reassertion of control over the government.

Forty Years Later: China in a New EraWelcome to Prevailing Winds

– For emerging markets investors, no country is more important to get right than China. Prevailing Winds will track the complex and contradictory forces that are shaping the Chinese economy.

Welcome

![[Chrome]](/_layout/images/ua/chrome.png)

![[Firefox]](/_layout/images/ua/firefox.png)

![[Opera]](/_layout/images/ua/opera.png)

![[Microsoft Edge]](/_layout/images/ua/edge.png)