- Brazilian pharmacies are evolving into service hubs with preclinical and diagnostic care.

- Pharmacy networks in Brazil are dense and support healthcare infrastructure throughout the country.

Avenida Paulista is a three kilometer historic avenue in São Paulo and considered a focal point of the city. Upon arriving it was the first area I visited and it brought back memories of Times Square in New York City – impressing upon me the staggering level of infrastructure development that São Paulo has achieved. Among the sea of restaurants, museums and corporate headquarters, there were several education institutions and pharmacies.

Unfortunately, soon after I arrived in São Paulo, I required some pharmaceutical assistance, so I visited a pharmacy, or “drogaria,” on the Avenida. Upon entering the drogaria, the operating differences compared to U.S. counterparts were immediately apparent. These pharmacies were a fraction of the size of a standard CVS or Walgreens in the U.S., but they were, in my view, much more efficient. Their inventory selection was smaller, as they had fewer household and consumer product offerings, but their real estate footprint was well utilized. As a consequence of their leaner stores, Brazilian pharmacies can operate closer to more patients. The country’s leading pharmacy retailer claims to be able to cater to 59% of the population within a five kilometer radius of its stores.12

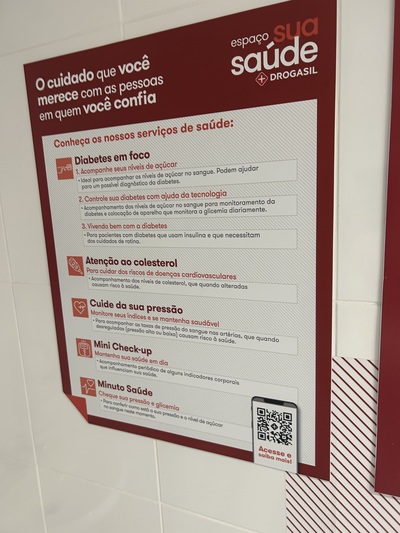

As a consequence of their density and proximity to the patient, pharmacies in Brazil have begun to occupy a more prominent role in the healthcare industry. Recent reforms enabled drogarias to provide preclinical and diagnostic care; these services are administered in dedicated sections of the pharmacy known as Hub Saúde, or Health Hub.

Health Hubs have been shaped by post-Covid government regulations, which were introduced in order to reduce congestion in emergency rooms by leveraging idle infrastructure at pharmacies. The inception of these services has transformed the role of the pharmacist from pharmaceutical dispenser to primary care provider. At these hubs, pharmacists not only administer vaccines and diagnostic tests – they even provide monitoring for patients with chronic conditions like diabetes. Some pharmacies claim to offer 43 different services.1

My visits to several of these Health Hubs, in addition to meetings with healthcare company management teams, emphasized the evolution underway in Brazilian pharmacies: as regulation liberalizes their operating parameters, these facilities are transforming from dispensing venues to healthcare centers.

According to pharmacy operators, over 80% of emergency room visits are classified as low urgency and can potentially be handled by these drogarias. Through these Health Hubs, pharmacies have the potential to reduce hospital congestion and shorten healthcare wait times in Brazil.13 Pre-Covid, under the previous administration, healthcare regulations were inflexible and archaic; however, under the new administration there has been a shift towards liberalization and improved healthcare access.

Rohan DalalSão Paulo

- The views and information discussed in this commentary are as of the date of publication, are subject to change, and may not reflect Seafarer’s current views. The views expressed represent an assessment of market conditions at a specific point in time, are opinions only and should not be relied upon as investment advice regarding a particular investment or markets in general. Such information does not constitute a recommendation to buy or sell specific securities or investment vehicles. It should not be assumed that any investment will be profitable or will equal the performance of the portfolios or any securities or any sectors mentioned herein. The subject matter contained herein has been derived from several sources believed to be reliable and accurate at the time of compilation. Seafarer does not accept any liability for losses either direct or consequential caused by the use of this information.

- As of June 30, 2024, securities mentioned in the commentary comprised the following weights in the Seafarer Overseas Growth and Income Fund: Raia Drogasil SA (2.0%). The Fund did not own shares in the other securities referenced in this commentary. View the Fund’s Top 10 Holdings. Holdings are subject to change.

- “RD Day 2023 Presentation.” RD Saúde, November 9, 2023

- Rotta, Inajara et al. “Role of Community Pharmacy and Pharmacists in Self-Care in Brazil.” Exploratory Research in Clinical and Social Pharmacy Vol. 10. April 23, 2023.

- Roman, Alex. “A Closer Look Into Brazil’s Healthcare System: What Can We Learn?.” Cureus Vol. 15(5). May 1, 2023.

![[Chrome]](/_layout/images/ua/chrome.png)

![[Firefox]](/_layout/images/ua/firefox.png)

![[Opera]](/_layout/images/ua/opera.png)

![[Microsoft Edge]](/_layout/images/ua/edge.png)