- A visit to an LG Twins baseball game revealed just how much South Korea’s large family-run conglomerates, known as chaebols, permeate daily life in Seoul.

- Efforts to reform corporate governance in the country face the daunting task of changing the behavior of these entrenched economic behemoths.

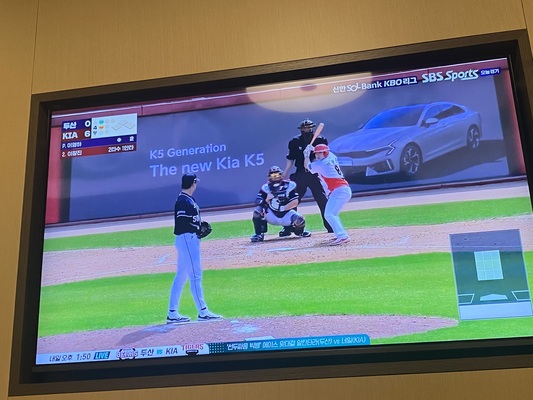

With the crack of a bat, Seoul’s Jamsil Stadium erupted in excitement. Drums banged, flags waved, and noise makers clapped in an outburst of elation. As the last runner stepped over home plate, the synchronized singing of thousands of jubilant fans began: “Salanghanda LG! Salanghanda LG! Seoul-ui LG seunglileul wihae nolae buleuja!” Or in English, “I love you LG! I love you LG! Let’s sing for the victory of LG in Seoul!”1 The LG Twins had just taken the lead over the NC Dinos. The LG fans, who had braved the rain that Sunday afternoon, were ecstatic. And all I could think about was corporate governance reform.

One of South Korea’s most popular spectator sports, baseball owes much of its popularity to chaebols. Founded in 1982, the Korean Baseball Organization League (or KBO) has ten teams that are owned and branded by the country’s largest business groups: the LG Twins, the Kia Tigers, the Samsung Lions, the NC Dinos, and the Lotte Giants, to name a few. I struggled to picture Americans literally singing their praise for the Microsoft Red Sox or the Coca-Cola Cubs. Yet I found myself surrounded by fans proudly wearing their LG-branded merchandise, entirely accustomed to the barrage of washing machine and refrigerator ads on the jumbotron between innings.

Beyond this overt manifestation of corporate branding, the influence of the chaebols runs deeply through day-to-day life in Seoul. The bottled water I drank that day was produced by Lotte Group. The same chaebol owns the distinctive 123-floor skyscraper that towers over Seoul’s skyline as a constant and nearly unavoidable presence throughout the city. The rows of cars in the stadium’s parking lots nearly all bore the logos of Hyundai or Kia; I likewise rode in my hotel’s Hyundai elevator and passed by a Hyundai shopping mall on my way to the game. While I am accustomed to Apple iPhones as the dominant smartphone, Samsung phones filled the stadium. Over 80% of smartphones sold in Korea are Samsung.2 Samsung’s business ventures span much further – insurance, hospitals, luxury hotels, biological pharmaceuticals, shipbuilding, stock broking, and even Korea’s largest theme park, Everland. Large corporations have an impact on people’s lives everywhere, but it's an entirely different ballgame in South Korea: revenue from the 10 largest chaebols represented nearly 60% of South Korea’s gross domestic product (GDP) in 2021.3

As I cheered along for LG, the extent of this corporate entrenchment was in clear focus. Corporate governance reform will be no easy task. Earlier this year, the Korean government announced a voluntary Corporate Value-up Program to encourage greater shareholder returns and capital efficiency by listed companies. With chaebol-related businesses constituting a significant share of the country’s equity market, the success of the Value-up Program will largely depend on the controlling families behind the chaebols changing their ways. More legislation, including both sticks and carrots, is likely needed to incentivize meaningful change. Will the public accept tax breaks for its billionaires? Will politicians risk the scorn of such powerful business groups? Does the LG Twins fan really care about corporate governance if their team is winning and their jobs are secure? With Korea’s economic fortunes still tied to the success of its chaebols, politicians face mixed incentives. The KBO itself may be symbolic of this tension as the chaebol-owned baseball league can make for good politics. Six Korean presidents, including the current president who is championing the Value-up Program, have thrown ceremonial first pitches at games.4 While it may be behind in the count, I do retain hope for corporate governance reform. The political incentives are slowly changing as public pensions face the prospect of deficits and depletion without higher investment returns, and Korea’s retail investor base grows as a political force. However, we are very much in the early innings and the cheering songs for reform are still being worked out.

Brent ClaytonSeoul

- The views and information discussed in this commentary are as of the date of publication, are subject to change, and may not reflect Seafarer’s current views. The views expressed represent an assessment of market conditions at a specific point in time, are opinions only and should not be relied upon as investment advice regarding a particular investment or markets in general. Such information does not constitute a recommendation to buy or sell specific securities or investment vehicles. It should not be assumed that any investment will be profitable or will equal the performance of the portfolios or any securities or any sectors mentioned herein. The subject matter contained herein has been derived from several sources believed to be reliable and accurate at the time of compilation. Seafarer does not accept any liability for losses either direct or consequential caused by the use of this information.

- As of June 30, 2024, securities mentioned in the commentary comprised the following weights in the Seafarer Overseas Growth and Income Fund: Samsung Electronics Co., Ltd. Pfd. (3.0%), Samsung Electronics Co., Ltd. (1.9%), Samsung Biologics Co., Ltd. (2.4%), Samsung SDI Co., Ltd. (1.8%), Samsung C&T Corp. (1.4%), and Hyundai Mobis Co., Ltd. (5.2%). As of June 30, 2024, securities mentioned in the commentary comprised the following weights in the Seafarer Overseas Value Fund: Samsung C&T Corp. (2.6%), Samsung C&T Corp. Pfd. (0.2%), and Samsung SDI Co., Ltd. (2.1%). As of June 30, 2024, the Seafarer Funds did not own shares in the other securities referenced in this commentary. View the Top 10 Holdings for the Seafarer Overseas Growth and Income Fund and the Seafarer Overseas Value Fund. Holdings are subject to change.

- A full list of the LG Twins’ cheering songs including playable musical renditions (in Korean language) can be found on the LG Twins website.

- Boram, Kim. “Samsung Electronics accounts for 84 percent of Q3 phone sales.” Yonhap News Agency, November 13, 2023.

- Anwar, Nessa. “Can South Korea’s Untouchable Chaebols Change?.” CNBC, February 22, 2024.

- Jee-ho, Yoo. “President Yoon Throws Out Ceremonial 1st Pitch at KBO Opening Day Game.” Yonhap News Agency, April 1, 2023.

![[Chrome]](/_layout/images/ua/chrome.png)

![[Firefox]](/_layout/images/ua/firefox.png)

![[Opera]](/_layout/images/ua/opera.png)

![[Microsoft Edge]](/_layout/images/ua/edge.png)