- Dubai is implementing policies to attract foreign talent and is opening its financial markets to foreign capital.

- Meetings with company management teams in Dubai revealed evidence of improved corporate governance: paying excess cash to newly minted minority shareholders.

Dubai is ascending, and I suspect it will be the next Hong Kong. A recent trip to the United Arab Emirates city felt like a breath of fresh air following two years of a travel ban due to Covid. It required much effort to prevent the pandemic-induced sense of doom and the concomitant economic gloom from overwhelming the benign outlook provided by company management teams over Zoom calls. Abandoning the comfort of the office chair for a plane seat, and the convenience of a Zoom call for face-to-face meetings confirmed the validity of two truths one could already intuit. The first truth is that one must form a sense of reality based on first-hand experience. Reading company annual reports and newspaper headlines is not a substitute for direct experience. Second, after three years of communication through Zoom calls, the value-added of in-person meetings became overwhelmingly apparent. The difference between the two modes of communication is akin to the difference between breathing through a mask and breathing without one. My first work-related trip since the start of the pandemic proved to be a breath of fresh air indeed.

Dubai proved the perfect antidote to the sense of doom and gloom. There, I encountered a city reminiscent of Hong Kong over twenty years ago. A city bustling with expatriates, with palpable optimism and entrepreneurial spirit. Unlike Beijing, which used the pandemic as a convenient backdrop to curtail Hong Kong’s freedoms and strengthen its grip over the economy at the expense of growth, Dubai used the pandemic to catapult its development. After a short six-week lockdown, the city took steps to attract foreign talent disaffected by Covid-related policies in their home countries, and to address the employment fallout stemming from the pandemic. The United Arab Emirates adopted new rules extending the Golden Visa granted to highly skilled individuals to ten years and created a new visa category for job seekers. The Emirates also made life easier for those already residing there by allowing the expatriate’s home country laws to govern cases of divorce and inheritance. It also decriminalized cohabitation by unmarried couples, even if this law was seldom enforced.

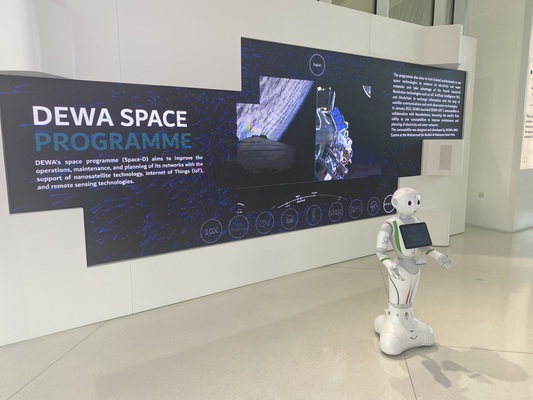

In addition to opening the Emirate to foreign talent, Dubai continues to open its financial market to foreign capital. A flurry of initial public offerings (IPOs) during 2022 motivated Seafarer’s visit to the city, in addition to the opportunity to meet with existing portfolio holdings. What the Seafarer team found was striking: companies that did not need capital but were willing to share their profit with investors. Indeed, all but one of the IPOs in Dubai and Abu Dhabi in 2022 were secondary offerings, and the dividend yields these companies offered were very high by global standards. A week of meetings revealed that these seemingly unnecessary IPOs form part of a broader plan to expand the capital markets first with companies that pay high dividends designed to attract long-term shareholders, to be followed by future primary offerings to fund economic growth. The country’s directive appears to be one of economic inclusion for both domestic and foreign investors.

The vision of a thriving Middle East with Dubai at its financial epicenter took form. Indeed, the competition between Dubai, Abu Dhabi, and Riyadh for economic primacy in the region was reminiscent of the rivalry between China, South Korea, and Japan at different levels of global corporate value chains. Arguably, the preconception of Asia as the future of the world economy risks missing the Middle East as another beacon of future progress.

Furthermore, the contrast between Dubai’s and Beijing’s response to the pandemic referenced above extends to corporate governance as well. The Dubai companies I met that had recently completed initial public offerings led by example by paying their excess cash to newly minted minority shareholders.

In summary, both Dubai as a city, and its corporates, are leading by example with enlightened policy making and corporate governance. The contrast against the largest country in the emerging markets investment universe, China, is instructive in signaling the destination of future capital.

Paul EspinosaDubai

- The views and information discussed in this commentary are as of the date of publication, are subject to change, and may not reflect Seafarer’s current views. The views expressed represent an assessment of market conditions at a specific point in time, are opinions only and should not be relied upon as investment advice regarding a particular investment or markets in general. Such information does not constitute a recommendation to buy or sell specific securities or investment vehicles. It should not be assumed that any investment will be profitable or will equal the performance of the portfolios or any securities or any sectors mentioned herein. The subject matter contained herein has been derived from several sources believed to be reliable and accurate at the time of compilation. Seafarer does not accept any liability for losses either direct or consequential caused by the use of this information.

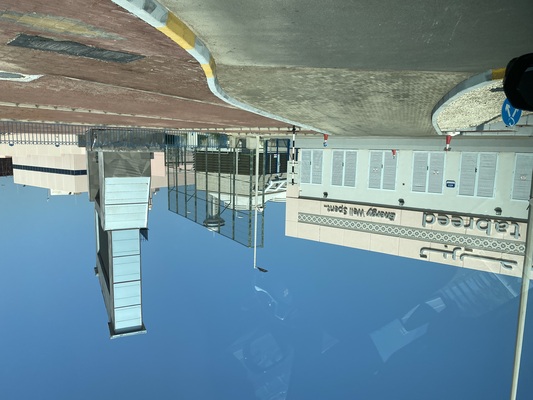

- As of March 31, 2023, National Central Cooling Co. PJSC (Tabreed) comprised 1.8% of the Seafarer Overseas Growth and Income Fund and 2.6% of the Seafarer Overseas Value Fund. The Seafarer Funds did not own shares in the other securities referenced in this commentary. View the Top 10 Holdings for the Seafarer Overseas Growth and Income Fund and the Seafarer Overseas Value Fund. Holdings are subject to change.

![[Chrome]](/_layout/images/ua/chrome.png)

![[Firefox]](/_layout/images/ua/firefox.png)

![[Opera]](/_layout/images/ua/opera.png)

![[Microsoft Edge]](/_layout/images/ua/edge.png)